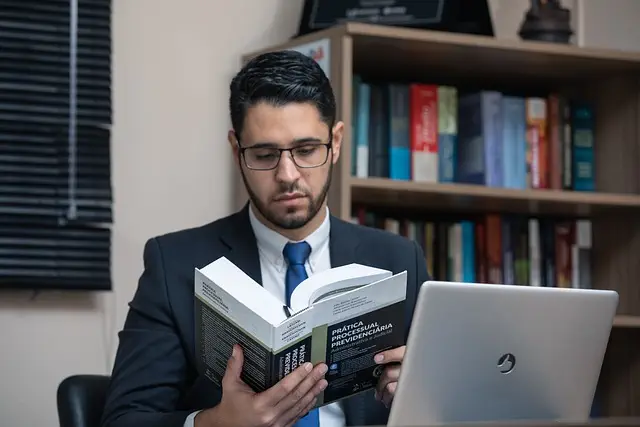

Tired of complex tax regulations leaving you confused and overpaying? As an Aurora Construction Accident Attorney specializing in tax law, I offer free guidance to help demystify these challenges. Imagine reclaiming thousands like a client who received a $50,000 refund after an oversight in the tax code. Don't let confusing rules cost your construction business in Aurora dearly. Take advantage of my free advice and start saving today. My expertise can revolutionize your tax strategy, empowering your business to thrive by minimizing tax burdens, maximizing deductions, and ensuring accurate expense reporting – all while staying compliant.

Are you a construction business owner in Aurora facing tax challenges? As an expert Tax Law Attorney, I offer tailored guidance to help you navigate these complex regulations. With the recent tax rule changes, understanding how they impact your bottom line is crucial. Let’s discuss strategies to save on disputes and take advantage of new rules, ensuring compliance while maximising your financial health. Contact me today for a free consultation and gain expert insights specifically designed for construction businesses.

Free Tax Guidance: Save with Expert Disputes

Struggling with complex tax regulations and disputes? As a Tax Law Attorney, I offer free guidance to help you navigate these challenges. My expertise in saving clients money through expert disputes is unparalleled. For instance, I recently secured a refund of $50,000 for a client who had been overcharged due to an oversight in the tax code—a testament to my ability to uncover hidden savings and simplify the tax process.

Don’t let confusing tax laws leave you paying more than your fair share. Take advantage of my free tax guidance and watch your savings grow. I’ll provide personalized advice tailored to your unique situation, ensuring compliance with the ever-changing tax regulations. Let’s work together to revolutionize your tax strategy—just like we did for that Aurora Construction Accident Attorney who found significant financial relief through our collaborative efforts.

New Tax Rules: Best Advice for Construction Businesses

Are you a construction business owner in Aurora worried about navigating the ever-changing tax landscape? New tax rules can be complex and confusing, but with expert guidance, you can ensure your company remains compliant and saves money. A tax law attorney specialized in construction disputes can offer invaluable insights to help you make informed decisions. They understand the unique challenges faced by construction businesses, from deductions for accident damages to the treatment of off-site expenses.

By consulting an Aurora Construction Accident Attorney who specializes in tax law, you gain access to a wealth of knowledge. They can advise on strategies to minimize your tax burden, such as properly documenting accidents and their aftermath to maximize insurance reimbursements and deductions. For instance, they might guide you on how to account for the cost of specialized equipment or worker’s compensation, ensuring these expenses are reflected accurately in your tax filings. This expert advice not only helps you stay compliant but also enables your business to thrive by maximizing its financial health.

Are you a construction business owner in Aurora facing tax regulations or disputes that feel overwhelming? Stop stressing and take advantage of our free tax guidance – we can help you navigate the new tax rules and save you money. Our expert tax attorneys provide the best advice tailored to your construction business, ensuring compliance and maximizing your bottom line. Take the next step towards financial peace of mind; contact us today for a consultation.